Home Office Deductions 2024 – All of that may make you wonder whether you can claim a home office tax deduction for your expenses on your federal income tax return. Read on for some answers. Some people who work from home can . Home Office Tax Deductions Definition: Income tax deductions you’re allowed to take if your home office passes the “exclusive use” text needed to qualify for the deduction Working at home can .

Home Office Deductions 2024

Source : m.youtube.com

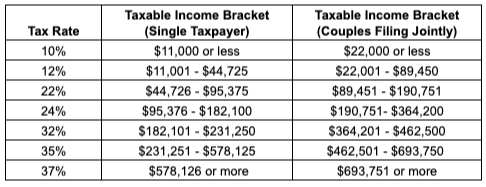

IRS announces 2024 income tax brackets – see where you fall

Source : news.yahoo.com

20 Popular Tax Deductions and Tax Credits for 2023 2024 NerdWallet

Source : www.nerdwallet.com

These Are the New Federal Tax Brackets and Standard Deductions for

Source : www.barrons.com

Kathy J. Wills, CPA

Source : m.facebook.com

The Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

FSA TAX | La Mesa CA

Source : m.facebook.com

Home Office Deductions Tax Tips YouTube

Source : m.youtube.com

Dawn Hooper, NACA In House Realtor

Source : www.facebook.com

Home Office Deductions 2024 Home Office Deductions Tax Tips YouTube: working from home allows you to deduct home office expenses on your tax return. But when you run two or more businesses from your home, or you share working space with your spouse, you should . But after the pandemic, most companies have begun reimbursing expenses incurred to set up a home office. This includes providing one-off payments to purchase required furniture and monthly .